Gold has become ₹1 lakh for every 10 grams, which means ₹1 crore for every kg.

Many people are saying that gold should be bought now, or not now, as it has become very expensive—wait for it to fall.

All these people are missing the big picture. To understand why gold could be an important asset,

why should we invest in gold?

What is the right form of buying gold?

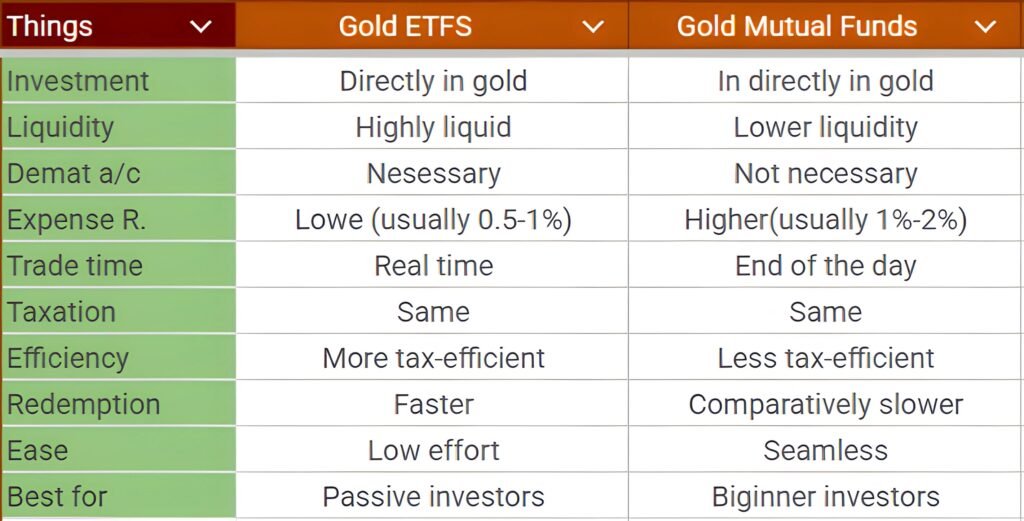

Gold ETFs vs Gold Mutual Funds—

This post will be your answer.

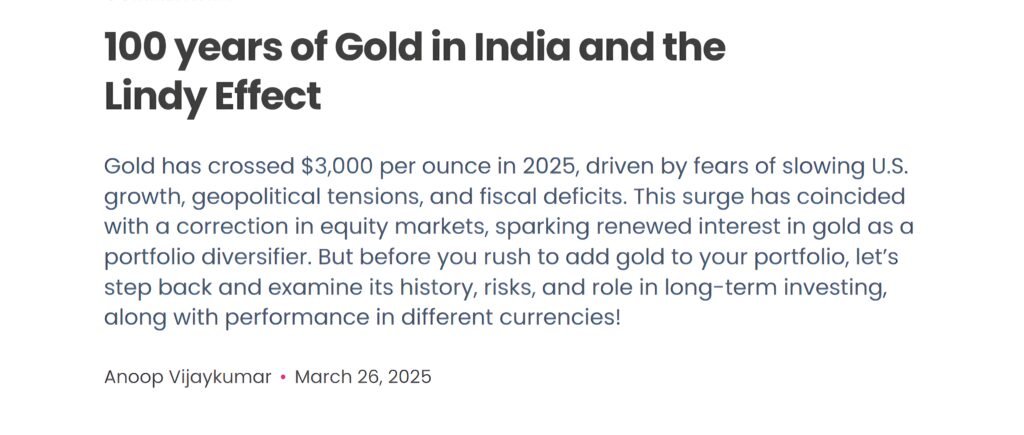

Capitalmind recently wrote an interesting article.

This was 100 Years of Gold in India and the Lindy Effect. I don’t know how many of you know about it, but it’s very powerful.

The article was written by Anup Vijaykumar, who is the head of Capitalmind. It’s a very good article—of course, with lots of details, you should read this article. check it out here: https://www.capitalmind.in/insights/100-years-of-gold-in-india-and-the-lindy-effect —but I’ll bring you to the most important point, which is this:

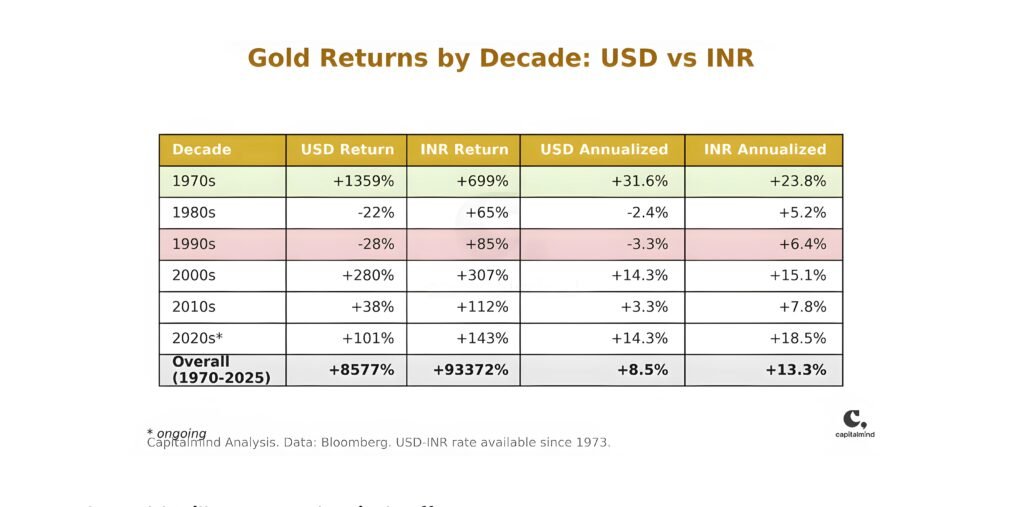

How about the Indian investor in gold?

So, what they have done is, they have basically figured out what gold returns have been by decade, both in USD (if you buy in USD), and INR converted on the USD exchange rate.

And you will see, from 1970 to 2025—so 55 years of data, or 5 decades of data—tell us that in INR, the annualized average rate of return for gold has been 13.3%.

To give you context, the Nifty 50 on average has returned between 12-13% over an extended period of time if you take a snapshot of 10, 15, 20, or 25 years.

Nifty 50, India’s top 50 companies listed on the National Stock Exchange, have on average, annually, given a return of 12-13%.

And here is gold, doing nothing, giving you a return of 13.3%.

Of course, there are a lot of other nuances. Gold jewellery does not give this return.

Gold bars have given this return, but with that come storage, safety, and other concerns.

Digital gold is also a very recent phenomenon. So, with all this, it’s unlikely that someone has invested in gold in the same way for 50-55 years. But if they had, this would have been the return.

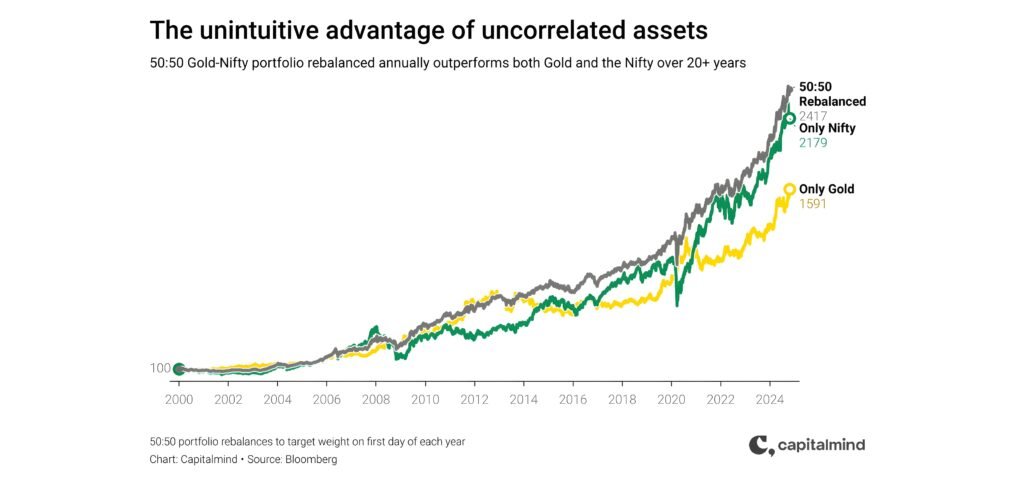

In fact, it goes on to do a very interesting analysis.

If we take a Nifty and Gold 50-50 portfolio, then what would be the performance? And look at how things are:

If you had taken only gold, you would be this yellow line.

If you had just Nifty, you’d be this line, which I think is greenish.

And if you had taken a 50-50 balanced portfolio—50% gold, 50% Nifty 50—you would be somewhere in between.

And the reason is because gold is usually considered a hedge against the stock market. Meaning, when the stock market is down, then gold is usually stable or goes up.

So, it kind of prevents a drawdown—meaning, how negatively your portfolio is going down.

The current data point is the COVID 2020 market crash. In March 2020, the market fell by 38.1%.

During that time, gold went up by 14%. In fact, from 2007 to 2025, which is a recent time period, if you had a 50-50 Nifty and Gold portfolio, you would get a 12.3% return and the drawdown would have been a maximum of negative 34%.

Meaning, even in the worst times, your portfolio would have gone down only 34%.

If you were purely in the stock market, the drawdown—the maximum negative return—would have been minus 59%. Approximately double the negative return.

So, gold clearly is a really nice stabilizing, balancing asset.

And I have often said that digital gold should be in your portfolio. Unfortunately, gold has grown so much, and the government has unfortunately executed SGBs in such a way that it’s unlikely SGBs will be introduced again.

So, you can buy SGBs in the secondary market right now, but primary issuance seems very unlikely.

Gold jewellery has been removed. SGBs have been removed.

Now there is only digital gold. You can buy gold bars, gold coins, but as I said, there are storage and security concerns. So, that leaves digital gold. And there can be two options in digital gold:

-

- Gold ETFs

- Gold ETFs

-

- Gold Mutual Funds

- Gold Mutual Funds

Let’s try to understand both.

Gold ETFs (Exchange Traded Funds)

In the last few posts, I was saying Equity Traded Funds, and people pointed out that mistake. It’s Exchange Traded Funds—ETFs.

ETFs are like stocks. You can consider them as stocks for the simple reason that when the stock market opens, you can buy or sell any ETF instantly, depending on demand and supply.

Gold ETFs actually buy physical gold as a backup for the investment you are making.

If you buy a unit of a gold ETF, that is equal to 1 gram of gold. So, you can start with that. There are also decimal units you can buy.

Gold Mutual Funds

Gold Mutual Funds are a fund. What is a fund?

Usually, if it’s a stock mutual fund, then they are buying multiple stocks.

If it’s a debt mutual fund, then they are buying multiple debt investments—corporate bonds, government treasury, fixed deposits.

Gold Mutual Funds invest in Gold ETFs. So, they create a layer where they balance multiple Gold ETFs to give you a desirable return.

They don’t operate like stocks—meaning, in the market, you cannot buy or sell a Gold Mutual Fund in real-time.

At the end of the market day (3:30 PM), at that point, the NAV (Net Asset Value) or stock price is used for buying or selling. So, there’s a slight delay in buying and selling Gold Mutual Funds—or any mutual fund.

Key Differences

-

- Gold ETFs. directly invest in physical gold as the backup for your capital.

-

- Gold Mutual. Funds invest in Gold ETFs. So, they are indirect buyers of gold, not direct buyers.

-

- To buy a Gold ETF, you need a demat account because it’s like buying and selling stocks.

-

- Gold Mutual Funds, if you buy through any broker or agent, then you don’t need a demat account. If you are buying directly, you will require a demat account. But many people in India buy Gold Mutual Funds or any other Mutual Fund through a broker or an agent. So, you don’t, per se, require a demat account.

-

- Gold ETFs, because they are buying gold directly, don’t need a big team, research wing, or anything. So their expense ratio is very low.

What is the expense ratio?

The expense ratio is the amount you pay to a Mutual Fund or ETF to run their business, because they also have to earn money. So, the Gold ETF expense ratios are typically around 0.5% to 1%. A simple way to understand this is that if you invest ₹100 in a Gold ETF, ₹99.5 or ₹99 will be invested in buying gold, and the remaining ₹0.50 or ₹1 will go towards the salaries and expenses of that Fund. That’s a simple way of understanding the expense ratio.

-

- Gold Mutual Funds, because they are a middle layer, have to analyze which Gold ETF to buy, which one to sell, and when to do so. For that, you need a team, an algorithm, and research. So, their expense ratio tends to be higher, between 1-2%.

-

- Gold ETFs, like any other ETF, have high liquidity. If the stock market is open, you can buy or sell anytime.

-

- Gold Mutual Funds, as I told you, are bought and sold at the end of the day.

-

- Because of this, the redemption of Gold ETFs—that is, the money in your bank—is also faster. You sell it, and you get the money the next day, which you can transfer instantly.

-

- Gold Mutual Funds. will book the order at the end of the day. The next day, that order will be processed. Then the following day, that money will come to your bank.

So, usually, there can be a delay of 24-48 hours. If, in between, business days are over—say, a weekend comes—then there can be more delays. So, if you are looking for rapid liquidity, ETFs are better; mutual funds, not so much.

-

- Taxes are the same for both: short-term and long-term capital gains tax.

Capital gains tax means, if you bought something for ₹100 and sold it for ₹120, then you have earned a capital gain of ₹20. That means you have earned a profit, and you have to pay tax on that ₹20.

The government says, if it is short-term—meaning if you have bought and sold within a year—then you have to pay a tax of 20%. If it is beyond a year, then you have to pay a tax of 12.5%.

It is quite possible that this long-term capital gains tax, which is 12.5%, will gradually increase to 15-20%, but according to the current situation, it is 20% and 12.5%. So, there is no difference in tax.

Now, since Gold ETFs invest directly in physical gold, they are not buying and selling very frequently. They are very passive funds. The capital gain or loss is usually a lot less.

So, it has been observed that ETFs become more tax-efficient because they don’t trade actively, whereas a Gold Mutual Fund will be buying and selling Gold ETFs many times—sometimes at a loss, sometimes at a profit. So you may actually get a capital gain even though your returns are more or less the same.

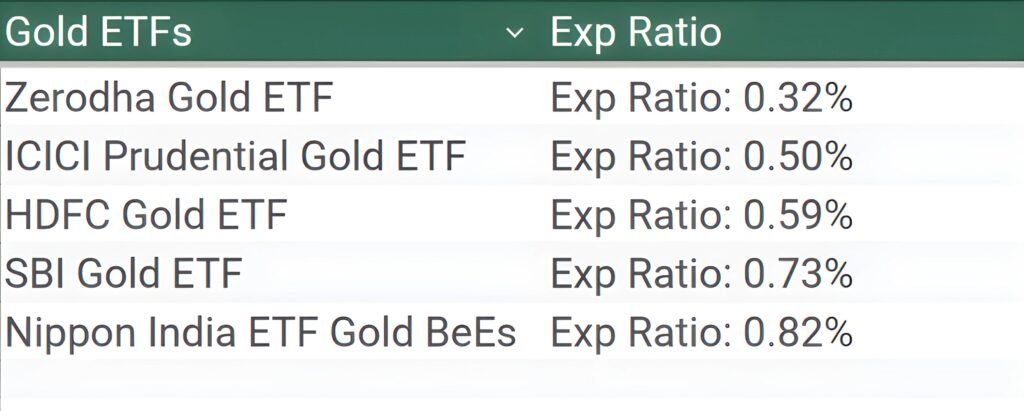

Okay, now which are the Gold ETFs that you can consider?

None of these are promoted. No one has paid me to mention their names. They don’t even have an idea that I am mentioning them.

I have personally used them, which is why I am recommending

Please make your own decisions based on your own homework.

Don’t go according to my advice. I am just trying to give you what could be a starting point for your research.

-

- Zerodha Gold ETF: Expense ratio of 0.32%

-

- ICICI Prudential Gold ETF – Expense ratio of around 0.5%. It’s a very big ETF with Assets Under Management of more than ₹7,000 crores, meaning people’s money is deployed in it.

-

- HDFC Gold ETF – Expense ratio is a little higher, 0.59%, and AUM (Assets Under Management) is around ₹9,000–10,000 crores.

-

- SBI Gold ETF – Expense ratio of 0.73%. and AUM is around ₹7,000-8,000 crores.

-

- Nippon India ETF Gold BeES – Expense ratio of 0.82% and AUM of above ₹18,000 crores.

This is the most famous or popular ETF.

- Nippon India ETF Gold BeES – Expense ratio of 0.82% and AUM of above ₹18,000 crores.

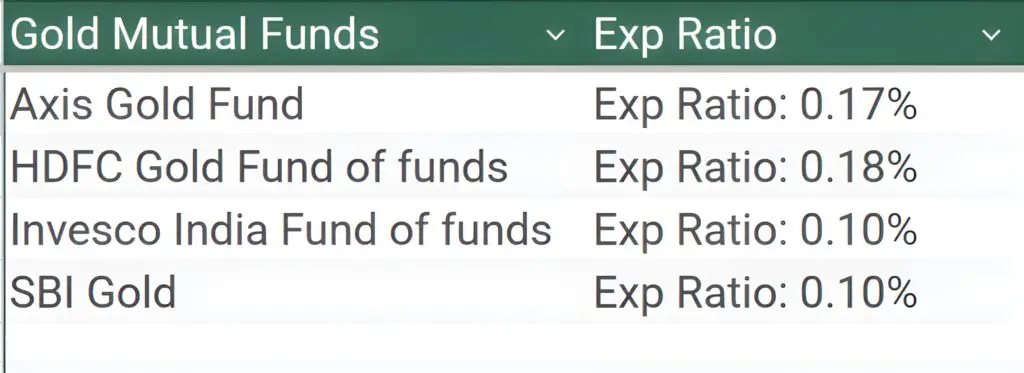

If we talk about Gold Mutual Funds, which ones are there?

Again, none of them are promoted or have paid me any money to take their names.

-

- Axis Gold Fund – Expense ratio of only 0.17% and CAGR of around 15%. Quite crazy.

-

- HDFC Gold Fund of Funds – They generate returns through a fund in ETFs.

Expense ratio of 0.18%.

- HDFC Gold Fund of Funds – They generate returns through a fund in ETFs.

-

- Invesco India Fund of Funds – Expense ratio of 0.1%.

-

- SBI Gold – Expense ratio of 0.1%.

Many are asking whether this is the right time to invest in gold.

I don’t have the answer to that because I am neither an expert nor do I make future predictions. I look at data from the last 50 years,

which I’ve already shared with you, and then I take a calculated call.

If I want gold in my portfolio, then I start an SIP and invest 5–10% of my portfolio in gold.

Every month, without doubt, I keep investing.

When the price is low, I buy more units. When it’s high, I buy fewer. Over time, I get the average return which history shows over the last 5 decades.

This same principle applies to equity mutual funds, debt mutual funds, and every other investment.

You and I are not experts. We can’t time the market.

In fact, those who try to time the market lose 99% of the time.

The best way is either to:

-

- Do deep research with strong reasoning, or

-

- Go with SIP, where you invest regularly and, over time, get returns close to historical averages.

So, if you want to invest in gold, you have to start buying gold at a rate of ₹1 crore per kilo.

Now is the time.

Which one would I recommend between an ETF and a mutual fund?

If you ask me, I would personally go for an ETF—because of its liquidity, ease, and low expense ratio.

You can buy and sell anytime like a stock, park your investment, and set up an easy SIP.

That’s my recommendation.

I hope this was helpful.